Mitteilungsverordnung ("Steuer-ID")

Für Zahlungen an externe Personen ist die HU verpflichtet, persönliche Angaben der Zahlungsempfänger*innen inklusive der deutschen Steuer-ID an das Finanzamt weiterzuleiten.

FAQ/Weiterführende Informationen für Mitarbeiter:innen der HU (Workspace/HU-intern)

German Tax ID

The German tax ID is a requirement by the german government, the university has to provide your German tax ID to the government agency for finances to reimburse you even if you are not living in Germany.

You can find more information about the regulation here (Website HU)

The application process in detail:

Tip: Most modern web browsers can translate all local sites and can give you more information about the forms in your language (in Chrome go to "Settings" and click "translate")

How do I apply for a German tax ID?

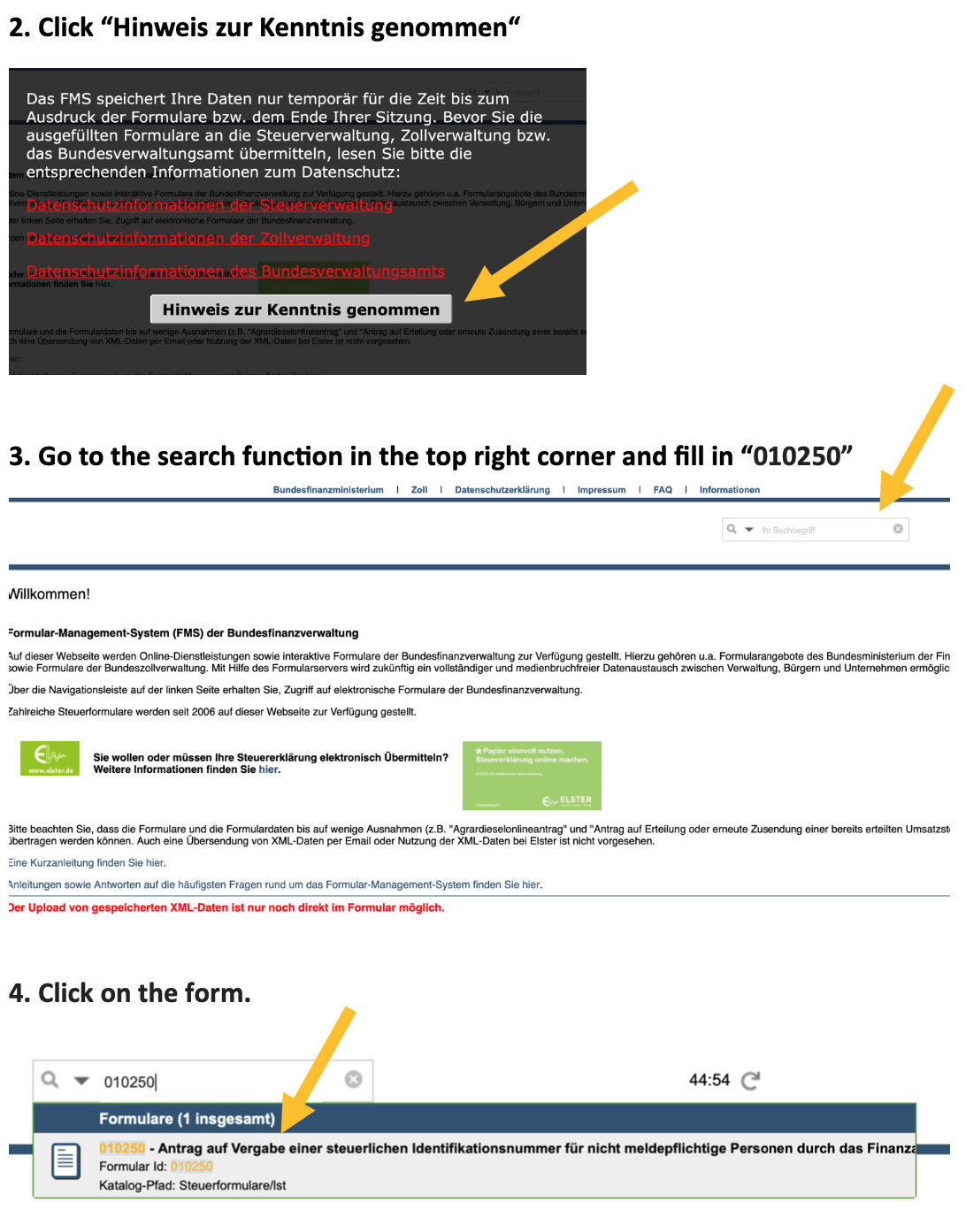

1. Go to https://www.formulare-bfinv.de/ffw/

2. Click the field “Hinweis zur Kenntnis genommen"

3. Go to the search field in the top right corner and

fill in “010250”

4. Click on the form in the new box

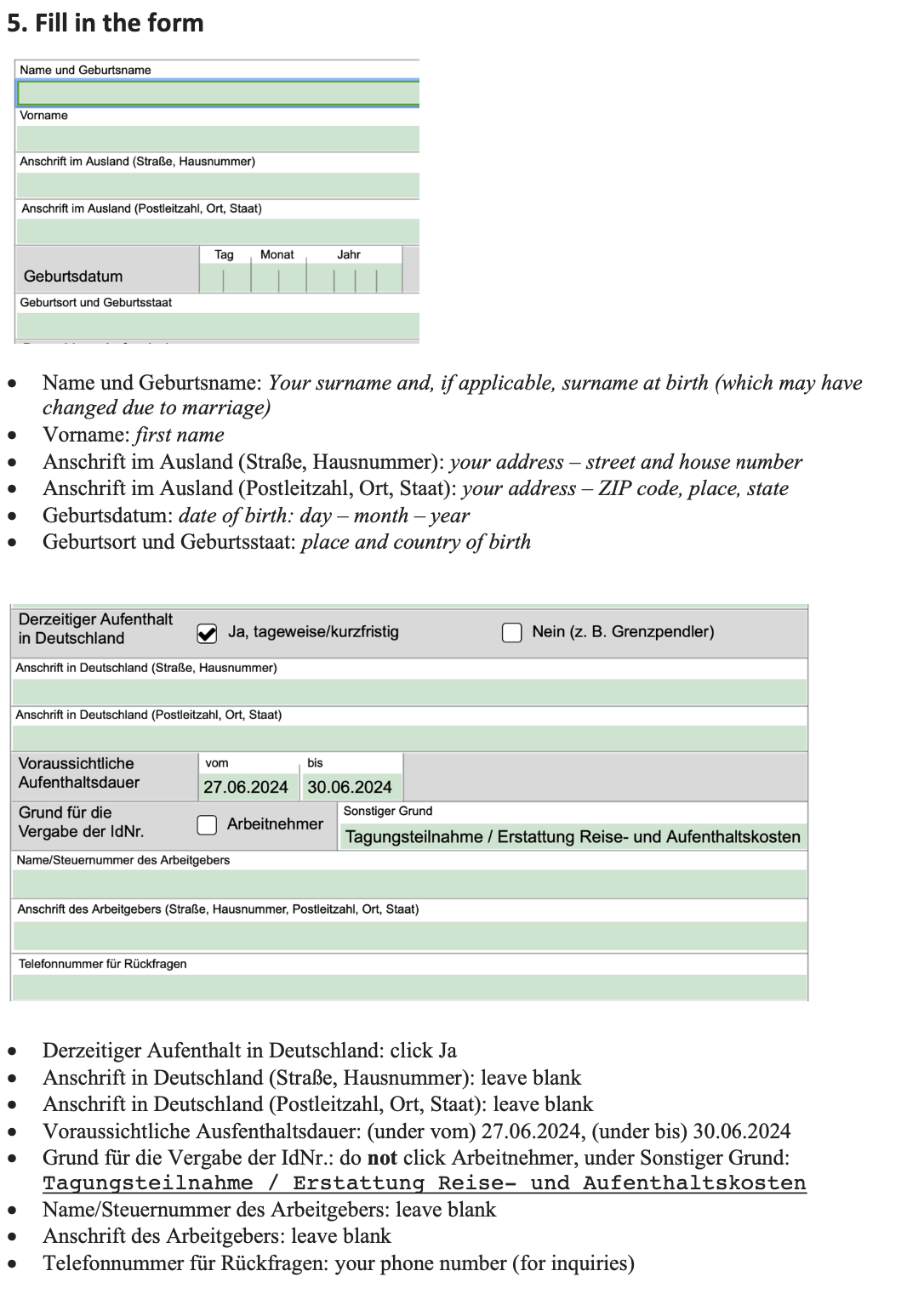

5. Fill in the form

- "Name und Geburtsname" > Your surname and, if applicable, surname at birth (which may have changed due to marriage)

- "Vorname" > first name

- "Anschrift im Ausland (Straße, Hausnummer)" > your address – street and house number

- "Anschrift im Ausland (Postleitzahl, Ort, Staat)" > your address – ZIP code, place, state

- "Geburtsdatum" > date of birth: day – month – year

- "Geburtsort und Geburtsstaat" > place and country of birth

- "Derzeitiger Aufenthalt in Deutschland" > click the box "Ja, tageweise/kurzfristig"

- "Anschrift in Deutschland (Straße, Hausnummer)" > leave blank

- "Anschrift in Deutschland (Postleitzahl, Ort, Staat)" > leave blank

- "Voraussichtliche Aufenthaltsdauer" > your time of visit in Germany

- "Grund für die Vergabe der IdNr.": do not click the box "Arbeitnehmer"

- under "Sonstiger Grund" insert the following german text: "Tagungsteilnahme / Erstattung Reise- und Aufenthaltskosten"

- "Name/Steuernummer des Arbeitgebers" > leave blank

- "Anschrift des Arbeitgebers" > leave blank

- "Telefonnummer für Rückfragen": your phone number including country code (for inquiries)

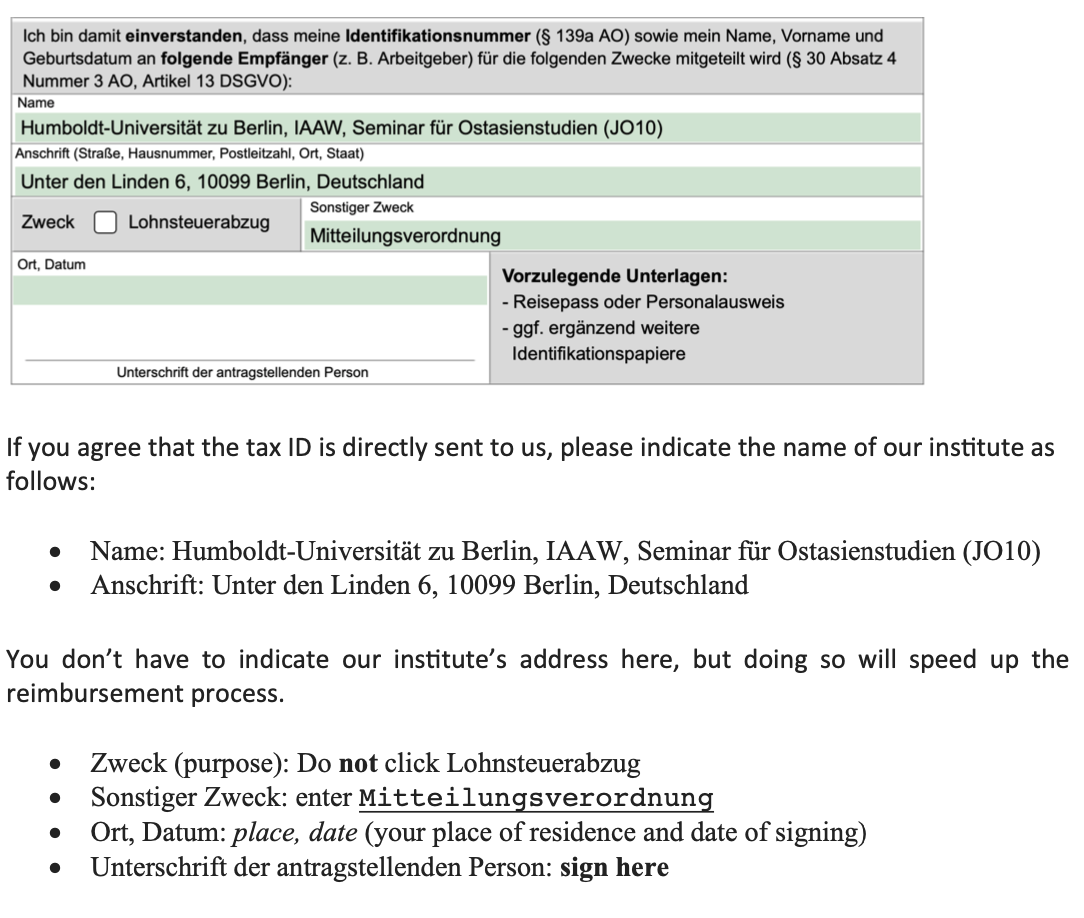

- If you agree that the tax ID is directly sent to us (You don’t have to indicate our institute’s address here, but doing so will speed up the reimbursement process.), please indicate the name of our institute as follows:

- "Name" > insert text "Humboldt-Universität zu Berlin, NAME OF THE INSTITUTE"

- "Anschrift" > insert text "Unter den Linden 6, 10099 Berlin, Deutschland"

- "Zweck" > Do not click the "Lohnsteuerabzug" checkbox

- "Sonstiger Zweck" > insert the follwing german text "Mitteilungsverordnung"

- "Ort, Datum" > place, date (your place of residence and date of signing)

- "Unterschrift der antragstellenden Person": sign here*

- * Unfortunately you can´t use a digital signature. You can add your signature as an image into the PDF via PDF editor or you have to print out the form, sign it, and scan it again for a signed PDF

- "Name" > insert text "Humboldt-Universität zu Berlin, NAME OF THE INSTITUTE"

How to submit the German tax ID application form?

Then you have to upload the form via another online site

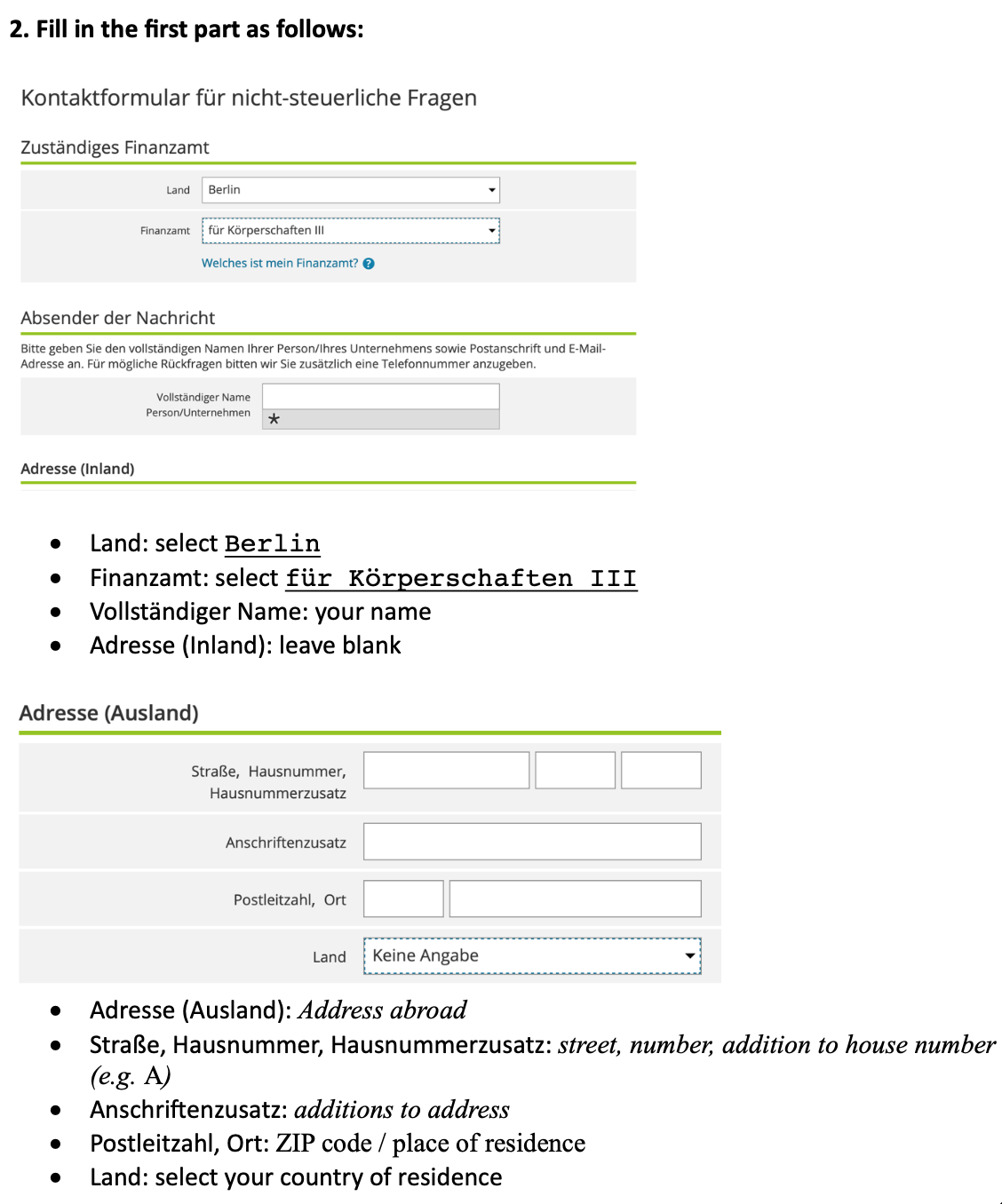

1. Go to https://www.elster.de/eportal/wizard/seq/nichtsteuerlichenachricht-4/eingabe

2. Fill in the first part as follows:

Dropdown "Land" > select "Berlin"

- Dropdown "Finanzamt" > select "für Körperschaften III"

- "Vollständiger Name": your full name

- "Adresse (Inland)" > leave blank

- "Adresse (Ausland)" > address abroad

- "Straße, Hausnummer, Hausnummerzusatz" > street, number, addition to house number (e.g. "A")

- "Anschriftenzusatz" > addition to address

- "Postleitzahl, Ort" > ZIP code / place of residence

- Dropdown "Land" > select your country of residence

- "Straße, Hausnummer, Hausnummerzusatz" > street, number, addition to house number (e.g. "A")

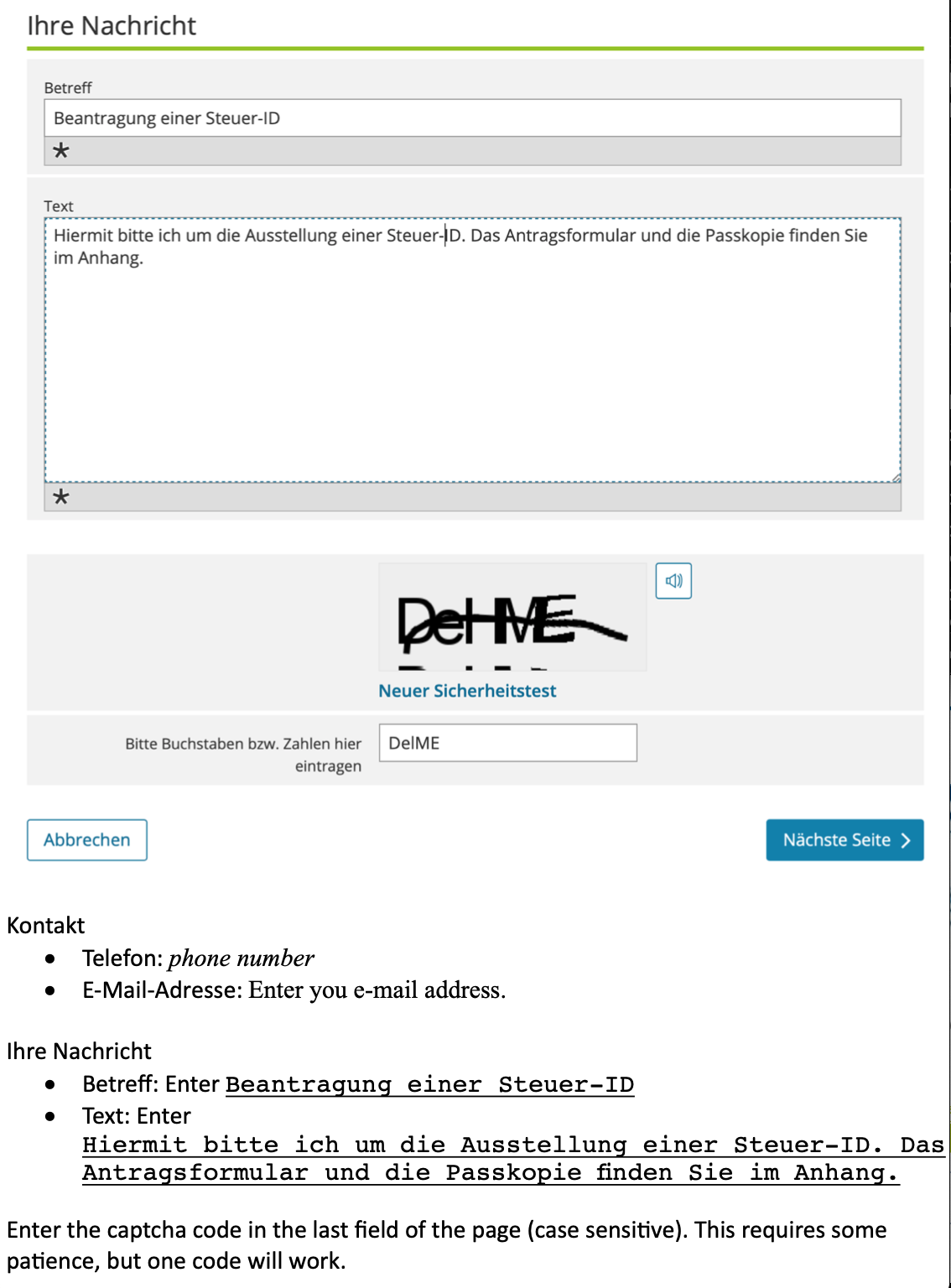

- Kontakt (contact info)

- "Telefon" > your phone number

- "E-Mail-Adresse" > Enter you e-mail address

- "Telefon" > your phone number

- Ihre Nachricht (your message)

- "Betreff" > Insert the german text "Beantragung einer Steuer-ID"

- "Text" > Insert the german text:

"Hiermit bitte ich um die Ausstellung einer Steuer-ID. Das Antragsformular und die Passkopie finden Sie im Anhang."

- "Betreff" > Insert the german text "Beantragung einer Steuer-ID"

3. Enter the captcha code in the last field of the

page (case sensitive). This requires some

patience, but one code will work.

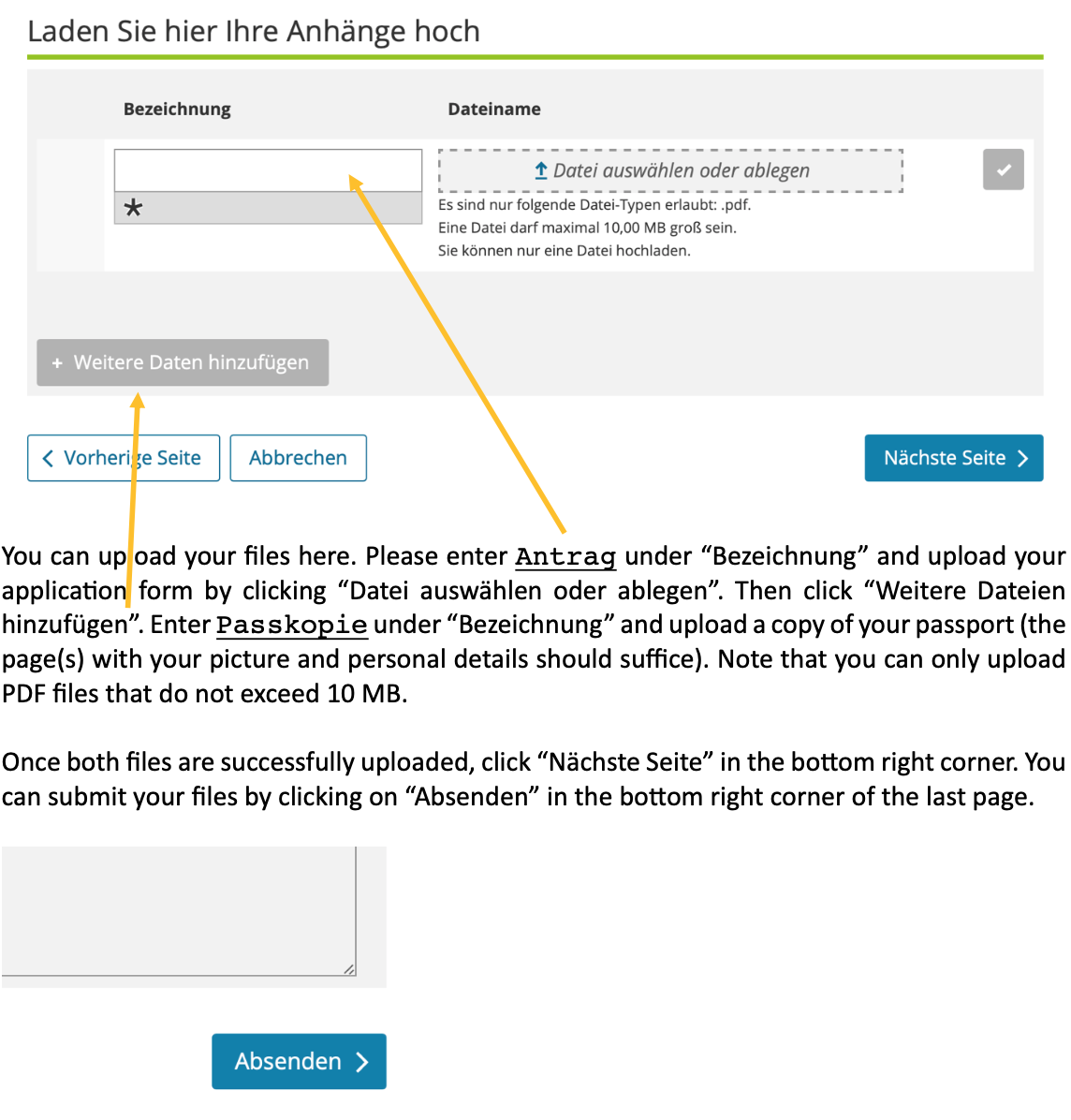

4. You have to upload your files here.

- Please enter "Antrag" under “Bezeichnung” and upload your application form by clicking “Datei auswählen oder ablegen”.

- Then click “Weitere Dateien hinzufügen”. Enter "Passkopie" under “Bezeichnung” and upload a copy of your passport (the page(s) with your picture and personal details should suffice).

- Note that you can only upload PDF files that do not exceed 10 MB.

5. Once both files are successfully uploaded, click

“Nächste Seite” in the bottom right corner.

You can submit your files by clicking on

“Absenden” in the bottom right corner of the

last page.

6. Then you have to wait for the mail with your

new Tax ID (it could take some several weeks).

7. Please send the Tax ID to your contact at our institutes.

https://seatable.cms.hu-berlin.de/dtable/forms/777899b6-7826-41dc-97c2-b9a449df8550/ Webformular Benutzerantrag Account SAP für Fakultäten und Zentralinstitute / User Request for SAP Account for Faculties and Central Institutes, Link anklicken, um auszufüllen

https://seatable.cms.hu-berlin.de/dtable/forms/777899b6-7826-41dc-97c2-b9a449df8550/ Webformular Benutzerantrag Account SAP für Fakultäten und Zentralinstitute / User Request for SAP Account for Faculties and Central Institutes, Link anklicken, um auszufüllen